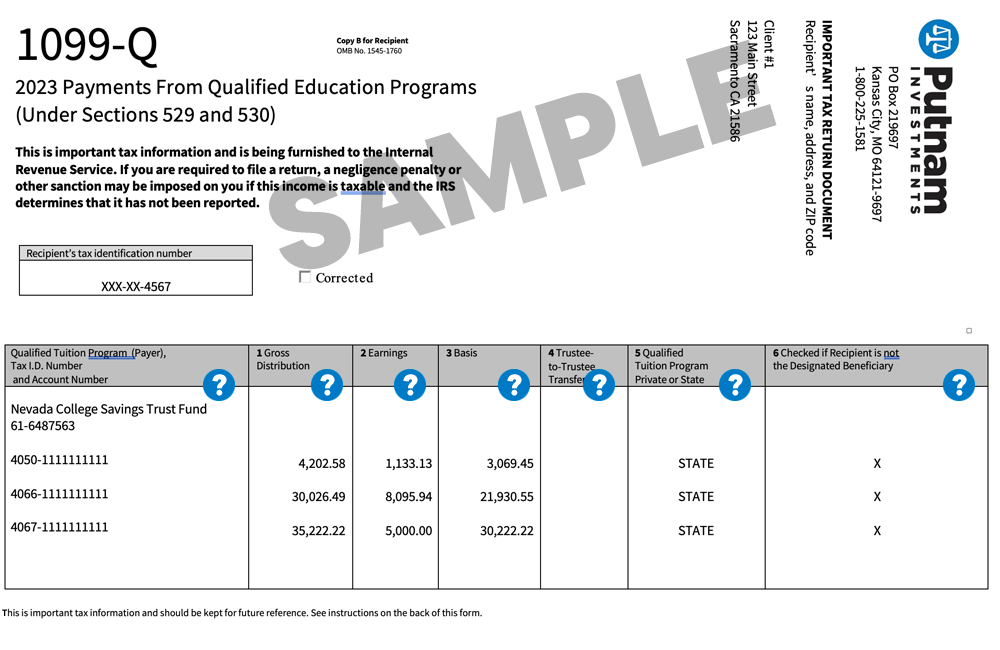

Families may take a qualified 529 plan distribution to pay for a prepayment plan of a qualified school. Some private colleges allow students to prepay for upcoming academic terms, at a fixed or discounted price. If a 529 plan account owner accidentally takes a distribution during the wrong tax year, they may roll the funds into the same or another 529 plan within 60 days to avoid taxes and penalties. Form 1098-T includes tuition and related fees, but does not include other qualified 529 plan expenses, such as room and board, computers and internet access or K-12 tuition. The amount of the distribution used to pay tuition should match the tuition reported on Form 1098-T, which they receive from the college. Taxpayers receive a Form 1099-Q from their 529 plan that lists distributions in a given tax year. There is no similar statutory language for 529 plans.

#529 distributions rules code#

The Internal Revenue Code of 1986 has an explicit exception for the AOTC at 26 USC 25A(g)(4) that allows one to make a prepayment for expenses for an academic period that begins during the first three months of the next tax year. Unlike the American Opportunity Tax Credit (AOTC), taxpayers cannot anticipate qualified 529 plan expenses that will be made at the beginning of the next tax year. If they wait until January (the next tax year) to pay the tuition, they should wait until January to withdraw funds from their 529 plan. If a family receives a spring semester tuition bill in December, they may take a qualified 529 plan distribution in December to pay the tuition bill. Spring semester typically begins in January, but colleges might send the bill in December (of the previous tax year). The longer funds are held in a 529 plan account, the greater the financial benefit.įamilies should pay attention to spring semester tuition bills. This is intended to prevent potential abuse where 529 plan account owners let their funds grow tax-deferred for an extended period of time before taking a distribution to pay for expenses incurred in a previous tax year.

Tax professionals and other experts agree that 529 plan distributions should match up with qualified expenses. This is not an official IRS rule, but it is implied by published IRS guidance.

Timing of 529 Plan Withdrawals Must Match Expensesĥ29 plan distributions must be made during the same tax year that the qualified expenses are incurred. Some prepaid tuition plans exclude time spent in active duty military service from the deadlines.

Some prepaid tuition plans have additional deadlines. Most prepaid tuition plans require the prepaid tuition plan to be used starting within 10 or 15 years after expected matriculation in college or by age 30. Withdrawal Deadlines for a Prepaid Tuition Plan Money in a Coverdell ESA must also be withdrawn within 30 days if the beneficiary dies. The earnings portion of any unspent funds after the beneficiary turns 30 years old are subject to a 10% penalty. Withdrawal Deadlines for a Coverdell ESAįamilies who use a Coverdell ESA to save for college are required to withdraw funds within 30 days after the beneficiary turns 30 years old unless the beneficiary has special needs. However, the rules are different with Coverdell Education Savings Accounts (ESAs) and prepaid tuition plans.

Use the funds to further their own education.Change the beneficiary to a qualifying family member.If the beneficiary decides not to go to college, or there are leftover funds in the account, the 529 plan account owner may: The 529 plan account owner, not necessarily the beneficiary, retains control of the assets throughout the life of the account. This is a huge benefit over other tax-deferred accounts. A 529 plan account owner is not required to take a distribution when the beneficiary reaches a certain age or within a specified number of years after high school graduation, and funds can remain in the 529 plan account indefinitely. 529 plans do not have specific withdrawal deadlines.

0 kommentar(er)

0 kommentar(er)